Accounting and Business Services

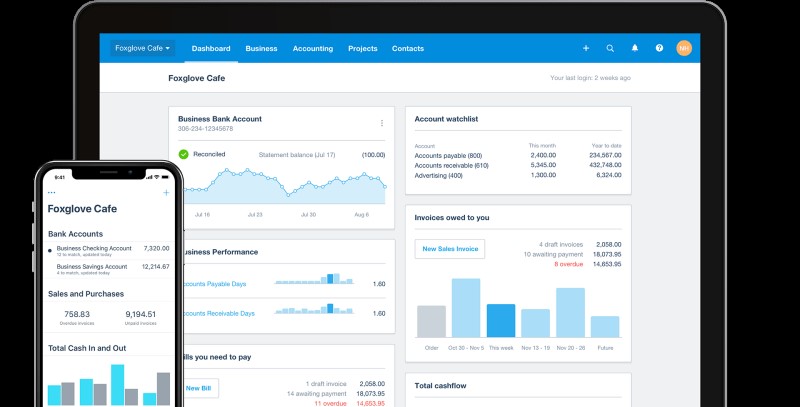

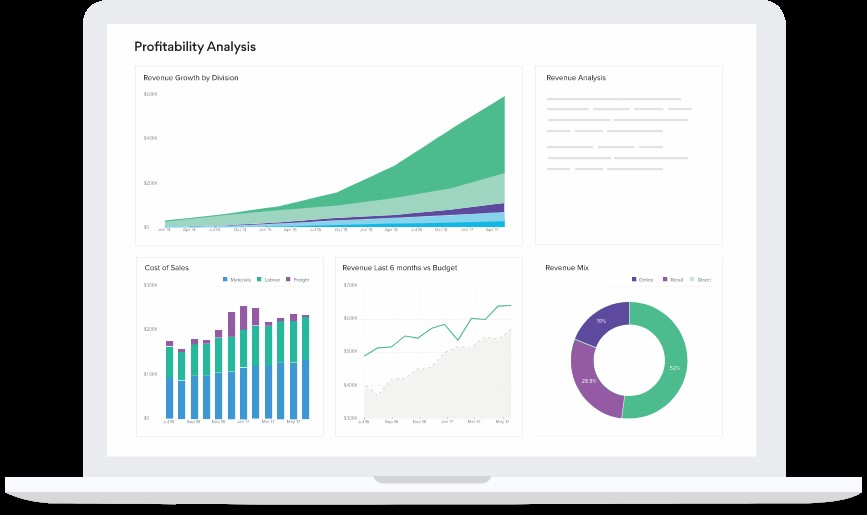

We take a proactive approach to your Business Accounting by making it easy for you to monitor the pulse of your business, keep track of cash flow, and other essential business performance metrics. We help individuals and small to medium businesses with their accounting & bookkeeping needs.

Outsourced Accounting & Bookkeeping

Small and middle market finance departments often struggle with turnover challenges, recruiting trustworthy employees with the expertise needed, slow monthly closes, and inaccurate accounting. The owner needs to focus on sales and operations, but the finance function can often become a costly distraction. The WiseAnt Group’s accounting services team understands and can provide experienced employees to implement a process and utilize technology solutions that meet your needs.

Let us handle your accounting and bookkeeping, so you can focus on running your business. We give you the insights, support and advice you need to have full visibility into your business financials.

We go beyond simple data entry and fancy reports. As your partner, we help you understand the story behind your numbers with real actionable steps to help you grow your business. Our goal is to eliminate all of your accounting and tax anxiety so you can focus on running your business.

How We Help:

We provide the following accounting and bookkeeping services to support your business:

Transactional accounting

Corporate accounting support

General consulting

With our team on your side, your business Financial Records and Bookkeeping will always be ready for tax season. We accurately record all of your business transactions with a tax-savings prospective. Tax preparation and filing is included in most packages or available as an add-on, our team of tax experts can prepare your tax returns accurately and efficiently based on your unique situation.

Whether you are a local business in Texas or have offices across the United States, we have your Tax, Accounting and Bookkeeping needs covered.

Catch-Up & Cleanup Bookkeeping

If you have been trying to manage your own Business Bookkeeping but you are unsure if everything has been captured and coded correctly, or your Business Bookkeeping has fallen behind as your business has grown, our team of experts can help!

We provide bookkeeping catch-up to help organize and clean-up your bookkeeping records such as:

Contact us today to see how we can help.

Business Services

We provide individuals and business owners with proactive and holistic planning services centered around their needs. Rather than clients receiving disjointed advice from multiple independent advisors, we bring all the necessary professionals together to work as ONE TEAM for you. Whether it’s starting a family, retirement, homeownership, investing or thinking about buying or selling a business, let’s work together to plan and meet your goals.

In partnership with other members of your financial team ranging from Financial Advisors to Attorneys, we take on the role of internal strategist, addressing short and long-term goals, improving cash flow, and identifying risks and opportunities unique to you.

Through this holistic Team approach, we have access to a network of trusted specialist in the following areas that we work with to provide you with the services you need:

Cost Remediation Analysis

Cost Remediation is an advance planning technique that focuses on decreasing business expenses and maximizing profitability for a business in order to maintain a competitive edge. We work with a Cost Remediation specialist to review all business expenses and identify key potential savings including items like shipping costs, credit card processing, manufacturing contracts, utility consumption, and lease audits.

Once the study identifies the key cost savings, a plan is drafted and the company performing the study will assist in the re-negotiation of existing contracts or establishing new contracts. A Cost Remediation Company is usually compensated as a percentage of the savings they can generate for a client. Companies performing Cost Remediations will often have a significant network of businesses that can offer competitive pricing on services without impacting quality.

Contact us today to see how we can help!

Business Valuations

This is the process of determining the value of a business as a whole or for a specific production unit. Business Valuations are an important stepping stone in order to implement other advanced planning techniques, especially when the business owner is considering a sale, merger or acquisition of a business.

We work closely with professionals trained in business valuations in order to estimates the value of your business using objective estimates and industry averages. Several evaluation models can be used for the determination of a business value therefore, working with an experienced business valuation professional is extremely important.

Contact us today to see how we can help!

Business Financing

Raising funds to start a business often requires outside financing. Selecting the best financing option for your business is a critical step that requires careful consideration. Business owners looking to expand their business or potentially consolidating existing debt must explore this option to take their business to the next level.

We work with business financing specialists connected to hundreds of lenders across the country in order to find the best business financing solution for your business. With a large network of lenders, we help our clients close the right loan based on their unique individual situation.

Contact us today to see how we can help!

Cost Segregation

A cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes. The primary goal of a cost segregation study is to identify all construction-related costs that can be depreciated over a shorter tax life (typically 5, 7 and 15 years) than the building (39 years for non-residential real property).

We work with professionals that specialize in cost segregations in order to audit-proof this technique and avoid potential challenges by the Internal Revenue Service. This allows the business owner to reduce current income tax obligations and increase cash flow.

Contact us today to see how we can help!

Succession Planning

Business exit or succession planning helps business owners develop an exit strategy to maximize their after-tax cash proceeds while meeting non-financial objectives. As you consider the next phase in your life, you want to ensure that you are exiting the business while maximizing your lifelong investment. Whether you are considering selling your business or planning to have your business managed by someone else, succession planning is essential in order to reach your goals.

We work with Succession Planning specialists to identify our clients’ best and most lucrative exit strategy based on their individual goals. Succession and exit planning strategies will vary based on the particulars of the business (size, industry, management structure, and cash flow), the state of the economy, the M&A market, and your personal objectives.

Contact us today to see how we can help!

Social Security Planning

Social Security Planning refers to the process of working directly with retirees and near-retirees, to develop and implement retirement distribution and wealth transfer strategies as it relates to Social Security. With a little proactive planning, we can help clients implement strategies that result in tens of thousands of dollars of additional benefits.

We work closely with Financial Advisors that specialize in Social Security Planning to identify the best strategies intended at maximizing Social Security Benefits.

Contact us today to see how we can help!

Long Term Care Planning

Long-term care is intended to cover a range of services that supports your personal care needs. Most long-term care is not medical care, but rather assistance with the basic personal tasks of everyday life like bathing, dressing, and eating. Long Term Care is usually very expensive, which is why most people need insurance. For example, on average, nursing facilities providing skilled care charge $150 to $300 per day, which is more than $80,000 a year! Without a plan, your retirement savings could be wiped out.

If you have assets to protect, a well-balanced retirement plan could include a Long-Term Care Policy intended to protect your retirement savings from being depleted unnecessarily. We work with Financial Advisors that specialize in Long Term Care Planning to identify the best options for your individual goals. Our Team-Based Model alliance brings you planning specialists centered around your individual needs and goals.

Contact us today to see how we can help!

Estate Planning

Estate planning is the process of designating who will receive your assets or wealth in the event of your death or incapacitation. Early Estate Planning allows you to protect both minor and adult beneficiaries from bad decisions, outside influences, and creditor problems. Our experts would work with you to put together an estate plan to ensure that your heirs and beneficiaries receive assets in a way that manages and minimizes estate taxes, gift taxes and other tax impacts.

We encourage our clients to use this process as one more opportunity to share with their children or family the lessons they’ve learned about success and what the money they have earned has allowed them to do for their family and community.

Our advisors and an estate planning professional can help you craft a plan to transmit wealth to your heirs in a thoughtful way.

Contact us today to see how we can help!

Internal Controls

Every business needs internal financial controls to help ensure things run smoothly and efficiently. Without internal controls, your business can risk employee fraud, cash flow shortages or even bankruptcy. We evaluate your current internal processes and controls to maximize efficiency and reduce the risk of fraud.

Contact us today to see how we can help!

New Business Setup & Compliance

Our Team can assist you with Business Formation and Compliance needs in all 50 States.

Personal Insurance

Life happens. Your insurance policies should reflect your uniqueness and lifestyle. We work with multiple insurers to offer a variety of comprehensive solutions, so you have peace of mind knowing you are adequately protected.

The WiseAnt Insurance team can help you understand the options available and determine the coverage needed to help protect you, your loved ones and property. Along with competitive rates, our team also works with you to present money-saving strategies, optional coverages and adds premium discounts to customize your policies.

We provide the following insurance coverage options for individuals:

Business Insurance

Protection of your property assets is more than just mitigating damages or disaster. It’s about protecting your future – lost income, create business continuity, increase recovery efforts and safeguarding your competitive advantage. The WiseAnt Group’s Property & Casualty team is ready to help you prepare for tomorrow’s risks today.

Businesses of all sizes encounter various types of exposures, and property & casualty liability insurance helps protect your business from financial loss. Through data analytics, efficient workflow and advanced reporting capabilities, our specialists help you identify the spectrum of risks and evaluate potential exposures to include features that may be missing or are expressly excluded. Whether your risks are people, on land, water or air, stationary or moving, domestic or foreign – we offer solutions to help you protect your property assets. We also offer solutions that help you identify your key cost drivers, manage your claims, mitigate future accidents and determine program structures that deliver results for your organization. We empower you to make educated purchasing decisions that reduce your overall property & casualty costs.

From small to medium businesses, we have the markets and know how to help you manage risks. We listen and provide solutions listed below, and customizable just for you.

Leverage our expertise to help you purchase adequate insurance coverage for you and your organization. Our experts are ready to help!

Subscribe to Our Newsletter

Welcome to the WiseAnt Group’s Subscription Center. This is your direct source for news, knowledge, and industry needs that makes it easy for you to tap into important, innovative resources such as, articles, webinars, videos, and live events. We invite you to sign up today to receive our inspiring and informative content..